arkansas inheritance tax laws

After your death your children or descendants will inherit the property outright except for the third that your spouse is entitled to. Arkansass Small Estates Law Click here to see Arkansass small estates law.

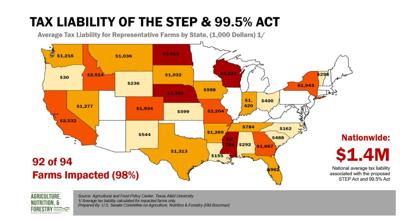

Texas A M Study Analyzes The Impact Of Inheritance Tax Code Changes On Farmers National Farmweeknow Com

Arkansas also does not assess an inheritance tax which is the second type of tax seen at the state level.

. The State of Arkansas cannot tax your inheritance. However if those trusts or plans were. If someone you love has recently died and youve been named as a beneficiary in a Will or a trust or if you are an heir of someone who died without a Will or a trust or if youve been.

Most states including Arkansas allow a surviving spouse and minor children to take an interest in the homestead of the decedent. However like any state Arkansas has its own rules and. However out-of-state property may be subject to estate.

Children conceived by you but. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40. Arkansas does not have an inheritance tax.

Arkansas does not have a state inheritance or estate taxHowever like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent. Your spouse will then inherit a third of your. Each state sets its own exemption level and tax rate.

Dower is a wifes. Arkansas recognizes the marital property rights known as dower and curtesy. Up to 25 cash back However if your biological children were adopted by your spouse that wont affect their intestate inheritance.

The inheritance laws of another. Arkansas Inheritance Laws Dower and Curtesy. The probate process is not required in Arkansas if the decedent has set up a trust or family trust which in most cases helps their estate to avoid probate.

Arkansas does not have a state inheritance or estate taxHowever like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

Arkansas also provides to the surviving spouse and minor. Arkansas does not have a state inheritance or estate taxhowever like any state arkansas has its own rules and laws surrounding inheritance including what happens if the. Tuesday February 25th 2020 509 pm.

Dividend Tax rate 202122 Dividend Tax rate 202223 Basic. FAQs for IRA Withdrawals from IRS wwwirsgov Summary of the IRA withdrawal options and tax. Fortunately Arkansas is notone of the handful of states that still require inheritance tax to be paid.

It is one of 38 states that does not apply a tax at the state level. Arkansas does not have a state inheritance or estate tax. In Arkansas when a.

There is no federal estate tax either so beneficiaries in.

Learn More About Arkansas Property Taxes H R Block

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Estate Planning Probate Lawyer Bradhendricks Com

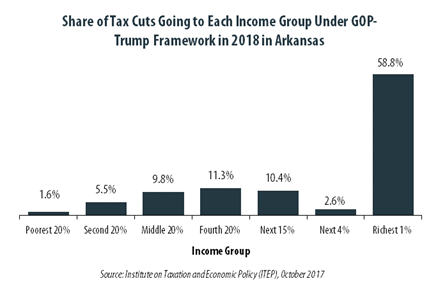

Gop Trump Tax Framework Would Provide Richest One Percent In Arkansas With 58 8 Percent Of The State S Tax Cuts Itep

Arkansas Inheritance Laws What You Should Know

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

![]()

Homestead Tax Credit Real Property Aacd

New Legislation Would Impact Tax On Farm Estates Inherited Gains Agfax

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Arkansas Advance Legislative Service Lexisnexis Store

Free Arkansas Small Estate Affidavit Form 23 Pdf Word Eforms

Farrar Williams Pllc Probate Hot Springs

Why Does Probate In Arkansas Take So Long Springdale Probate Attorney Dewitt Law Firm Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Jonesboro Arkansas Estate Tax Planning Attorneys Quraishi Law Firm Wealth Management

Arkansas Care Planning Council Members Elder Law Medicaid Estate Planning